App Screenshots

App Description

Enjoy the power of instant money with Stashfin – one of India's fastest, easiest, safest, and smartest Credit Line and Instant Personal Loan Apps. Stashfin is powered by Akara Capital Advisors Private Limited, an NBFC duly registered with Reserve Bank of India (RBI). With its quick and easy application process, Stashfin lets you enjoy a credit line of up to ₹5,00,000 at low-interest rates and flexible repayment plans that are best suited to your needs. Why is Stashfin One of the Best Loan Apps in India? • Credit line ranging from ₹1,000 to ₹5,00,000 straight to your bank account • Pay interest only on the loan amount you utilize. • Repayment period: 3 to 36 months • Minimum documentation, instant approval, and quick disbursal We also provide funds as low as ₹1,000 and up to ₹5,00,000 and are operational Pan India. Stashfin offers personal loans with instant access to funds for whatever your needs are. Enjoy funds from Stashfin for all your needs including travel, shopping, medical emergencies, debt consolidation, wedding, home upgrade, home renovation, education, gadgets, consumer durables and others. Stashfin provides quick, easy, flexible solutions for instant loan requirements In matters of funds, one size doesn’t fit all and we offer you the choice of picking a credit line best suited to your needs and help you take control of your finances. We offer interest rates ranging from 11.99% - 59.99% APR (Annual Percentage Rate), however rates may vary case to case. All loans are paid through Equal Monthly Instalments (EMIs) via electronic payment. A low processing fee is charged in certain cases and there are no hidden costs. Example: Amount: ₹10,000 Tenure: 3 months Rate of Interest: 11.99% p.a. Processing Fee: ₹0 Total Interest: ₹167 EMI: ₹3389 APR: 11.99% Amount Disbursed: ₹10,000 Total Repayment Amount: ₹10,167 Sample Monthly EMI with Sample Principal and Interest EMI Principal Interest ₹3389 ₹3305.74 ₹83.25 ₹3389 ₹3333.26 ₹55.73 ₹3389 ₹3361.01 ₹27.98 How does Stashfin Work? Follow these easy steps to get instant personal loan and solve all your cash needs • Download the Stashfin App and register • Fill in your details and upload verification documents • Once verified the final application status can be checked on the App. You will also be notified of your approval status via SMS • Once approved, E-sign the loan agreement and the approved amount will be disbursed to you within 5 minutes. SMS notification will be sent to your registered number notifying the same Eligibility Criteria for Instant loan • Indian Citizen • Above the age of 18 • Must have a source of income (either salaried or self-employed) Documents Required for Instant loan • Address Proof (any one of Aadhaar Card/Voter ID/Passport/Driving License) • Identity Proof (PAN ID) In some cases, you may be asked for the following documents • Bank Statement • ITR/ GST Paper Operational pan India Delhi NCR (Delhi, New Delhi, Noida, Greater Noida, Faridabad, Ghaziabad, Gurgaon), Mumbai, Thane, Pune, Hyderabad, Chennai, Bangalore, Indore, Chandigarh, Panchkula, Pithampur, Bhiwandi, Zirakpur, Kharar, Coimbatore, Kolkata, Udaipur, Jaipur, Lucknow, Kanpur, Bhopal, Shimla, Haridwar, Ranchi, Ahmedabad, Mangalore, and more. Security & Protection of Privacy Data security and privacy is a top priority at Stashfin. Our backend APIs comply with mandated security standards and robust protocols which have been tested and certified. Stashfin has partnered with reputed and well regulated entities like SBM Bank, DMI Finance, Visu Leasing Finance, AU Small Finance Bank, Kisetsu Saison Finance, Chola Finance and Western Capital.

What's New

You might also like

Basic Info

com.Stashfin.iOS

5.5.1

Finance

Requires iOS 12.0 or later. Compatible with iPhone, iPad and iPod touch.

English

4+

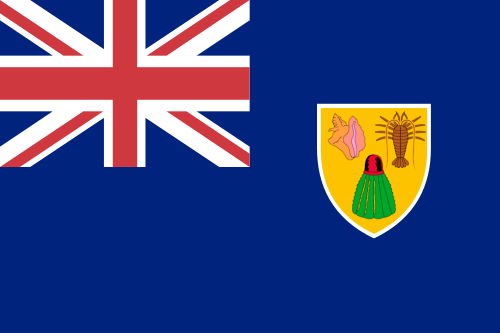

China,United States,Taiwan, China,China Hong Kong,Japan,Korea,India,Malaysia,Canada,Brazil,United Kingdom,Russia,Germany,Australia,Egypt,South Africa,Mauritania,Niger,Libya,Armenia,Madagascar,Kenya,Azerbaijan,Denmark,Zimbabwe,Bahrain,Namibia,Thailand,Sierra Leone,Kazakhstan,Mozambique,Guinea-Bissau,New Zealand,Argentina,Tajikistan,Angola,Antigua and Barbuda,Philippines,Malawi,Nicaragua,Colombia,Tanzania,Lithuania,Latvia,Saint Kitts and Nevis,Turkmenistan,Rwanda,Solomon islands,Myanmar,Swaziland,Guatemala,Yemen,Botswana,Afghanistan,Sweden,Maldives,Suriname,Liberia,Dominican Republic,Mauritius,Kuwait,Indonesia,Chile,Singapore,Barbados,Nepal,Gambia,Belize,Fiji,Vanuatu,Papua New Guinea,Netherlands,Republic of Moldova,Cambodia,Guyana,Bermuda,Chad,Dominica,Italy,Malta,Macao, China,Laos,Sao Tome and Principe,Bhutan,Mongolia,Mexico,Seychelles,Brunei Darussalam,Belgium,Pakistan,Sri Lanka,Tonga,Cayman islands,British Virgin islands,Turks and Caicos islands,Anguilla,Poland,Bahamas,Palau,Micronesia,St.Vincent and the Grenadines,Saint Lucia,Peru,Senegal,Grenada,Montserrat,Nauru,Romania,Ukraine,Tunisia,Serbia,France,Venezuela,Ireland,Slovakia,Austria,Bosnia and Herzegovina,Paraguay,Costa Rica,Turkey,Iceland,Nigeria,Greece,Morocco,Congo, Democratic Republic,Czech Republic,Ghana,Norway,Bulgaria,Hungary,Montenegro,Cameroon,Qatar,Jamaica,Burkina Faso,Ecuador,Croatia,Finland,Honduras,Albania,Slovenia,Bolivia,Mali,Cote d'Ivoire,United Arab Emirates,North Macedonia,Uruguay,Algeria,Salvador,Saudi Arabia,Panama,Cape Verde,Uganda,Portugal,Zambia,Belarus,Israel,Uzbekistan,Luxembourg,Lebanon,Oman,Cyprus,Switzerland,Gabon,Benin,Congo,Trinidad and Tobago,Georgia,Kyrgyzstan,Estonia,Jordan,Vietnam,Spain

Not supported

Open

Ranking

Ranking